Ever thought about what happens if you made a mistake on your life insurance application? The results can be serious. Insurance companies can cancel your policy if they find out you lied. But what counts as a big lie, and how does it affect your coverage and your loved ones’ benefits? Let’s dive into this important topic.

Key Takeaways

- Misrepresentations on life insurance applications can lead to policy rescission and denied death benefit claims

- Insurance companies have the right to investigate for material misrepresentations, especially within the first two years of a policy

- Common examples of material misrepresentation include inaccurate weight, undisclosed medical history, and misstating age or substance use

- Rescinded policies are treated as if they never existed, leaving beneficiaries without the promised death benefits

- Legal recourse is available for beneficiaries facing denied claims due to alleged misrepresentation

Understanding Material Misrepresentation

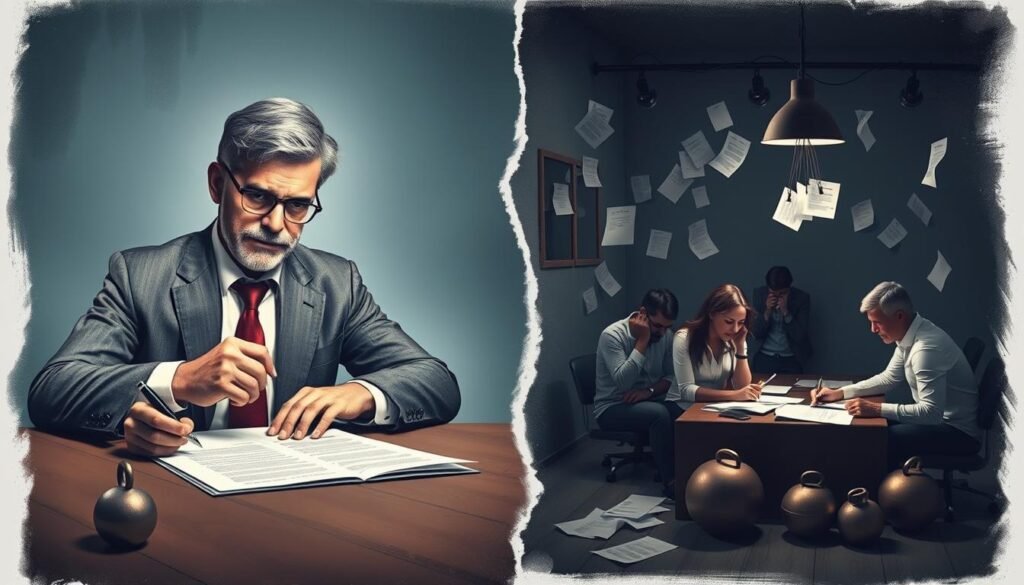

Life insurance policies rely on accuracy and honesty. Material misrepresentation is a key issue. It’s when someone gives false or misleading information that affects the insurance company’s decision.

Defining “Material” and “Misrepresentation”

In life insurance, material misrepresentation means giving wrong info on the application. This could be about health, lifestyle, or other factors that affect risk. The information must be material, meaning it’s important to the insurer’s decision on premiums.

Material Misrepresentation in the Insurance Context

Providing false info on an insurance application can lead to big problems. If an insurer finds out, they might cancel the policy, change premiums, or deny claims. The company’s actions depend on the policy and state laws.

| Example | Consequence |

|---|---|

| Sarah misrepresents her weight on the life insurance application, stating 150 pounds instead of her actual weight of 200 pounds. | This material misrepresentation can lead to premium adjustments to reflect the increased risk associated with Sarah’s actual weight. |

| David falsely claims to be a non-smoker on his life insurance application while being a regular smoker. | The smoking misrepresentation can result in premium adjustments due to the higher risk associated with smoking. |

| Lisa fails to disclose her pre-existing medical condition, such as diabetes, on her life insurance application. | The failure to disclose this material information can lead to policy rescission if discovered during the contestability period. |

It’s important for both applicants and insurance companies to understand material misrepresentation. Being honest and clear during the application process helps avoid problems. It ensures life insurance policies work smoothly.

What Happens When a Misrepresentation on a Life Insurance Policy is Discovered

If an insurance company finds a material misrepresentation on a life insurance policy, they can rescind the policy. This action makes the policy seem like it never existed. The company can then deny any claims and refund any premiums paid. It’s important for policyholders to know the risks of giving wrong information when applying.

Insurance Company’s Right to Rescind Policy

Life insurance policies usually have a contestability period of two years. During this time, the insurer can check for any misrepresentation or fraud in the application. If they find a material misrepresentation, they can rescind the policy. This makes the policy seem like it never existed.

Common Examples of Material Misrepresentations

Some common material misrepresentations include wrong information about the policyholder’s health, medical history, lifestyle, or other risk factors. This can include substance use, dangerous activities, or incomplete background information.

| Type of Misrepresentation | Example |

|---|---|

| Health and Medical History | Failing to disclose a pre-existing medical condition or treatment |

| Lifestyle and Activities | Underreporting participation in high-risk hobbies like skydiving |

| Background Information | Providing inaccurate details about criminal history or employment |

If the insurance company proves that the policyholder intentionally gave wrong information that was material to the decision, they can rescind the policy. They can also deny any claims made after that.

The Two-Year Contestability Period

In the United States, there’s a key two-year window called the contestability period for life insurance policies. During this time, insurance companies can review the policyholder’s application. They might cancel the policy if they find any material misrepresentations.

After two years, the insurance company usually can’t cancel the policy, even if they find big mistakes in the application.

But, the mistake must be material to cancel the policy. Small errors or omissions might not cause a policy to be canceled.

Insurer’s Ability to Rescind Policy Within Two Years

The life insurance contestability period lets insurers check the application review for material misrepresentation. If they find a big mistake, they can cancel the policy within two years.

This time helps insurance companies protect themselves. It lets them find and fix any unintentional errors or fraudulent behavior before the policy can’t be changed.

Insurance companies think two years is enough to find any material misrepresentation. This time lets them do post-claims underwriting and check for any issues when a claim is made.

Legal Consequences and Recourse

The legal effects of lying on a life insurance policy differ by state. In New York, the insurance company must show the policyholder lied on purpose. Other states focus more on if the lie mattered. If a claim is denied, the person or their family can appeal. They might need a life insurance attorney for help.

State Laws Governing Material Misrepresentation

In New York, the insurance company must prove the lie was big enough to affect the policy. They also have to act fairly when checking claims. If they don’t, they could face legal trouble.

Fighting Denied Claims Due to Alleged Misrepresentation

Lawyers like Ted Treif, Barbara Olk, and Eyal Dror can help with denied claims. They’ve been practicing for decades. They can talk to insurance companies or go to court for you.

The incontestability clause in policies can also protect you. It lasts for two years and helps against claims of lying after that time.

| Statistic | Value |

|---|---|

| U.S. insurance fraud incurred annually | $308.6 billion |

| Life insurance fraud annual cost | $74.7 billion |

Material misrepresentation and claim denials can lead to big legal problems. But, you have options to appeal and get your policy reinstated. Knowing your rights and the laws in your state can help you fight for your life insurance claim.

Preventing Misrepresentation on Life Insurance Applications

Getting life insurance is a big financial step. It’s key to give correct info to make sure the policy works right. If you lie on your application, you could face big problems. This includes denied claims, less money for your family, or even losing your policy.

To avoid these issues, always tell the truth and give all the details on your application. This means sharing all relevant medical conditions, medications, and lifestyle factors that might affect the insurer’s view of risk. If you lie about your age, weight, income, or other important stuff, you might get less money or have claims denied, even if you paid all your premiums.

Working with your insurance agent can also help make sure your application is right. They can help you fill out the form and answer any questions you have.

Also, regularly checking your policy documents and telling the insurer about any changes is important. This keeps the insurer’s records up to date and makes sure your coverage fits your life now.

By focusing on life insurance application accuracy, disclosing medical conditions, verifying information, and working with your insurance agent, you can avoid lying and make sure your policy protects you as it should.

| Potential Consequences of Misrepresentation | Strategies to Prevent Misrepresentation |

|---|---|

|

|

“Honesty is the best policy when it comes to life insurance applications. Misrepresentation can lead to costly consequences, so it’s crucial to be truthful and thorough.”

By being proactive and honest, you can safeguard your financial future. This way, your life insurance policy will give you the coverage you need.

Conclusion

Life insurance misrepresentation can lead to big problems. Your policy might be canceled, and claims could be denied. It’s key to tell the truth and be open when filling out your application to avoid these issues.

If your claim is turned down because of misrepresentation, you or your family might be able to fight it. You have legal options to appeal the decision.

It’s vital to give accurate and complete info on your application. Lying or leaving out important details can ruin the purpose of life insurance. It’s meant to protect your family financially.

By being honest and transparent, you ensure your life insurance will be there for your family when they need it. Life insurance is meant to give you and your loved ones peace of mind and financial security.

Keeping honesty and openness in the application process is crucial. It helps keep your policy strong, no matter what the future brings.

FAQ

What is a material misrepresentation on a life insurance policy?

A material misrepresentation is a false or misleading statement. It’s something big enough to change an insurance company’s mind about giving you a policy. This usually means not telling the truth about your health, lifestyle, or other things that could affect your risk.

What happens if an insurance company discovers a material misrepresentation on a life insurance policy?

If an insurance company finds out about a material misrepresentation, they can cancel your policy. This means they treat your policy as if it never existed. They can then deny any claims and give back any money you paid.

What are some common examples of material misrepresentations on life insurance policies?

Some common examples include lying about your health or medical history. Or not telling the truth about your lifestyle or other risk factors. These things could have changed the insurance company’s decision to give you a policy.

How long does the insurance company have to review a policy for material misrepresentations?

In the U.S., insurance companies have two years to check for misrepresentations. This is called the contestability period. After two years, the insurance company usually can’t change their mind, even if they find big mistakes in your application.

What are the legal consequences of material misrepresentation on a life insurance policy?

The legal outcomes depend on the state’s laws. Some states need to prove you meant to lie. Others just look at if the lie was important. If your claim is turned down because of a lie, you might be able to fight it in court.

How can I prevent issues with misrepresentation on my life insurance policy?

To avoid problems, always tell the truth and be detailed on your application. Share all your health issues, medicines, and lifestyle choices. Work with your agent to make sure everything is right. Also, check your policy often to make sure it’s correct.