Ever thought about how to file a successful flood insurance claim? Dealing with a flood can be tough, but knowing the claims process is key to getting back on track. Whether you own a home, rent, or run a business, flood insurance is your safety net during disasters. We’ll show you how to handle the flood insurance claims process and get the most from your claim.

Key Takeaways

- The National Flood Insurance Program (NFIP) provides coverage for property owners, renters, and businesses.

- Claim processing times can vary, so regular communication with your insurance company is crucial.

- Thorough documentation, such as photos, videos, and receipts, strengthens your insurance claim.

- Negotiating settlement offers can help ensure you receive the full compensation you’re entitled to.

- Specialized training programs for insurance adjusters can improve their expertise in handling flood claims.

Understand the Claims Process

When dealing with flood insurance claims, it’s key to set realistic expectations. Your clients might not understand their flood insurance policies or how long claims take. As their agent, you guide them through this tough time.

Setting Realistic Expectations

Explain to your clients what their policy covers, including deductibles and exclusions. This avoids surprises later. Remember, they’re already stressed, so your guidance is vital.

Filing the Initial Claim

Urge your clients to contact you right after a flood. This starts the claims process quickly and ensures they have the right forms. NFIP policies have a 60-day limit to provide a proof of loss statement.

By managing expectations for flood claims and helping through the claims process, you make this hard time easier for them.

“Quick reporting of water damage incidents to insurance providers leads to faster claim processing.”

Document Flood Damage Thoroughly

When filing a flood insurance claim, detailed documentation is crucial. Start taking photos and videos of the damage as soon as it’s safe. Use a high-resolution camera for clear shots, starting with wide views and then close-ups of damaged items.

Also, make a detailed list of all damaged property. Include a description, brand, model, and serial number for each item. This careful documentation will help your insurance claim and increase your chances of success.

Capture Visual Evidence

- Use a high-resolution camera to take clear, detailed photos and videos.

- Start with wide-angle shots of each affected area, then move in for close-ups.

- Capture the visual evidence of flood damage to support your insurance claim.

Itemize Damaged Property

- Create a comprehensive inventory of all damaged items.

- Provide a detailed description, including the brand, model, and serial number for each item.

- This meticulous itemizing of flood-damaged property will strengthen your insurance claim.

By thoroughly documenting the flood damage, you’ll be on the right path to a successful insurance claim. The more detailed your documentation, the stronger your case will be.

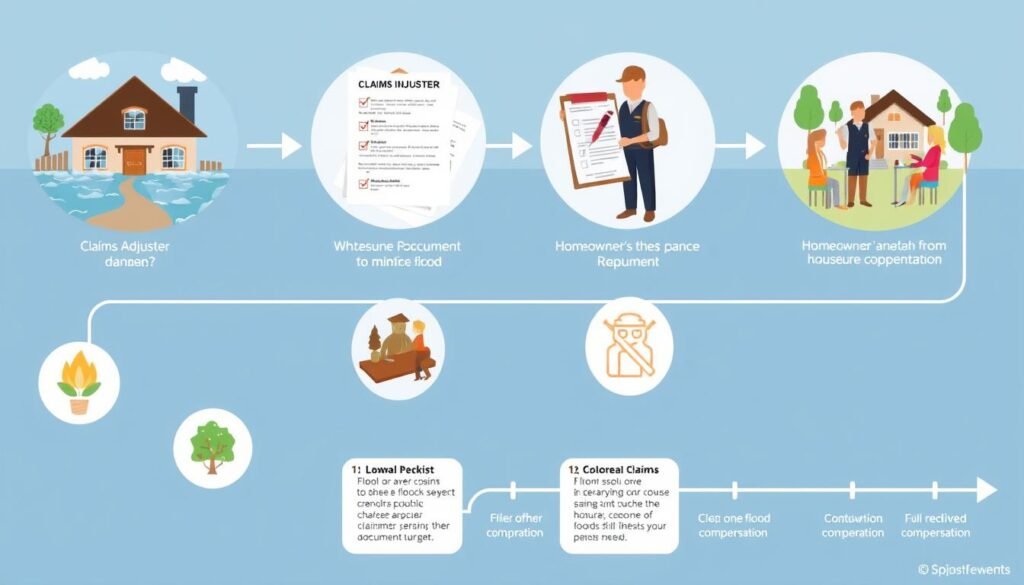

Flood insurance claims: how to navigate the process successfully

Handling flood insurance claims can seem tough, but with the right steps, your clients can get a good outcome. Knowing the key steps and preparing well can help them through the process. This way, they can get the compensation they’re owed.

Reporting the Flood Damage

It’s important to report the flood damage to the insurance company quickly. This starts the claims process and lets the insurer check the damage. Give them all the details about the flood, like when it happened and what was damaged.

Documenting the Damage

Good documentation is key for a successful claim. Tell your clients to take photos and videos of the damage before and after cleaning. They should also make a list of what was damaged or lost, including the item’s details and value.

Filing the Claim

After reporting and documenting the damage, it’s time to file the claim. They’ll need to fill out a Proof of Loss form. This form shows how much damage there is and how much they want paid. Make sure to send this form and any supporting documents on time.

By following these steps and understanding the claims process, you can help your clients succeed. Being proactive and thorough is crucial for a smooth claims process.

| Flood Insurance Claim Tips |

|---|

| – Report flood damage to the insurance provider as soon as possible |

| – Thoroughly document the damage with photos, videos, and itemized lists |

| – File the Proof of Loss form within the specified timeframe |

| – Maintain detailed records of all communications and expenses |

| – Consider seeking assistance from a public adjuster if needed |

By following these tips and using insurance experts’ knowledge, your clients can successfully go through the flood insurance claims process. They will get the compensation they deserve.

Work with the Insurance Adjuster

When dealing with a flood insurance claim, it’s key to work well with the insurance adjuster. They check the damage, look over your documents, and figure out how much you lost. Being open and clear is crucial for a smooth claims process.

Prepare for the Adjuster’s Visit

When the adjuster calls to set up a meeting, be flexible. Get your documents ready and make sure the damaged areas are easy to see. Have photos, videos, and lists of damaged items ready to support your claim.

Provide Comprehensive Information

When the adjuster comes, give them all the info they need and answer their questions. Show them your photos, videos, and lists, and explain the damage. Be thorough and highlight any big concerns. The more you share, the better they can understand the damage and how much to pay.

Keep in mind, the adjuster wants to settle the claim fast and for the least cost to the insurance company. Stand up for a fair deal and get help from a public adjuster or lawyer if needed.

By working well with the adjuster and sharing all the details, you can get your flood insurance claim settled quickly and fairly. Stay informed, keep records, and ask for help if you need it.

Conclusion

As you’ve gone through the flood insurance claim process, it’s key to take steps to avoid future damage. Talk to your insurance provider about ways to protect your home, like moving utilities and appliances up. These actions might even lower your premiums by reducing flood risk.

Filing a flood insurance claim can seem tough, but with the right info and prep, you can feel confident. Knowing the important terms, documenting damage well, and keeping in touch with your insurer helps you recover faster. Remember, while the journey to recovery can be tough, the right strategies can help you get through the flood insurance claims process.

The main things to remember for flood claims are: be proactive about protection, know your policy well, document damage thoroughly, and stay in touch with your insurance provider. By following these tips, you can help yourself through the claims process. This way, you can get a fair settlement and start rebuilding your life.

FAQ

What should I expect when filing a flood insurance claim?

Filing a flood insurance claim can be tough. But knowing the process helps. Talk to your clients about their policy, deductibles, and what’s covered. Tell them to call you right after the flood to start the claims process.

How can I help my clients document the flood damage thoroughly?

Teach your clients to take clear photos and videos. They should also save receipts and make a detailed list of damaged items. The more they document, the stronger their claim will be.

What role does the insurance adjuster play in the claims process?

The adjuster checks the damage, looks at the documentation, and figures out the loss. Tell your clients to be open and share all information during the visit. This helps get an accurate assessment.

How can my clients prepare for the insurance adjuster’s visit?

Encourage your clients to organize their documents and make damaged areas easy to access. During the visit, they should show their photos, videos, and inventory. They should also explain the damage in detail to the adjuster.

What steps can my clients take to prevent future flood damage?

Talk to your clients about steps to prevent future damage. Suggest elevating utilities and appliances. They might even get lower premiums for taking these steps to reduce flood risk.